The stock market is often influenced more by market psychology than by a company’s actual performance or value. The stock price of Fuji Media Holdings (Fuji HD), the parent company of Fuji TV, experienced significant fluctuations following Nomura Securities’ rating change, Masahiro Nakai’s statement, and Fuji TV President Minato’s press conference. In this rebound drama, we analyze the differences between investors who cried and those who laughed, focusing on stock price movements and investor psychology.

Stock Price Movements: A Fact-Based Analysis

Although this series of events lasted only about a month at the end of 2024, it provides valuable insights into market behavior. Let’s take a closer look at the key events and stock movements in chronological order.

Surge Following Rating Upgrade

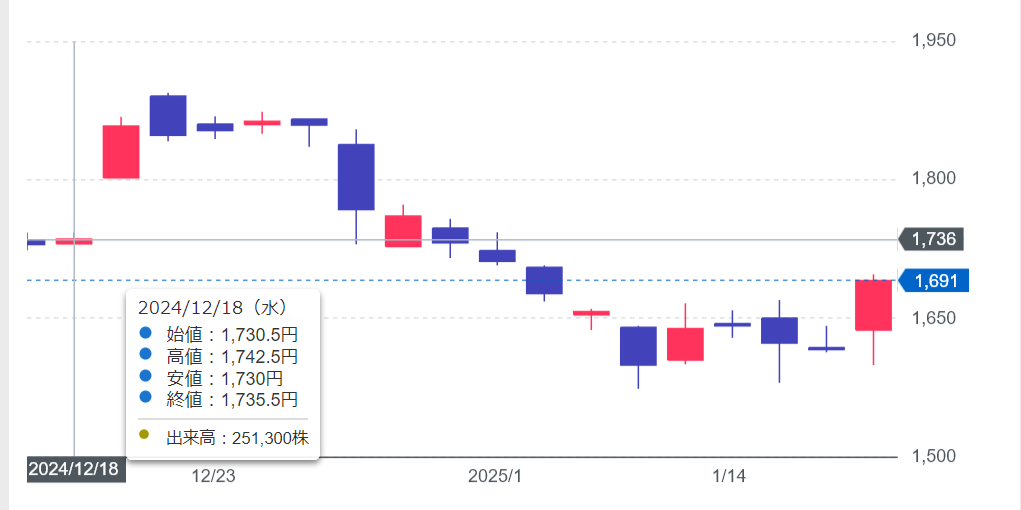

On December 19, Nomura Securities upgraded Fuji HD’s rating to “Buy,” citing the expansion of its non-terrestrial advertising business. The stock price soared to nearly 1,900 yen following this upgrade, as investors anticipated further growth.

Plunge Following Scandal Report

However, everything changed on December 26 when a scandal involving Masahiro Nakai was reported by a weekly magazine. The report mentioned a settlement amounting to 90 million yen over a personal dispute, leading investors to worry about Fuji TV’s brand image and advertising revenue. The stock price plunged, falling below 1,500 yen at one point.

Rebound After Nakai’s Statement

On January 9, Nakai issued a statement declaring that “Fuji TV is not involved,” which helped stabilize the market. This statement provided a sense of relief, possibly triggering short-covering activities and helping the stock price recover.

Investors Who Cried and Investors Who Laughed

Stock fluctuations brought both gains and losses to investors. What made the difference?

Investors Who Cried: Those Who Kept Buying Aggressively

Investors who continued to buy aggressively after the rating upgrade faced a sharp decline due to the scandal report, forcing many to cut their losses. This situation was particularly painful for short-term traders expecting further gains.

Investors Who Laughed: Those Who Profited from Short Selling

Investors who anticipated the scandal and took short positions profited significantly from the sharp decline. Some professional investors likely repurchased their positions just before Nakai’s statement, securing additional profits.

Investors Who Bought During the Rebound

Investors who saw Nakai’s statement as a “bottom” and bought shares below 1,500 yen enjoyed gains during the subsequent rebound. Such calculated decisions are often seen among long-term investors.

Lessons from Stock Price Movements

This month-long event serves as a classic example of how sensitive and emotional the stock market can be.

The Possibility of Insider Information

In hindsight, the fact that the stock price stagnated at 1,900 yen despite a target price of 2,420 yen might have seemed unnatural. The timing of the scandal report right after the rating upgrade and subsequent plunge might not have been a coincidence. Some investors may have had prior knowledge, although insider trading is illegal. It’s important to remember that such information is not accessible to the general public.

Differences Between Short-Term and Long-Term Strategies

Short-term traders focus on market fluctuations and technical indicators to make quick profits, whereas long-term investors prioritize the company’s fundamental value and sustained revenue growth. In this case, both short-term profit-seekers and long-term investors were present. Investors who reacted emotionally suffered losses.

Understanding Investor Psychology

Understanding market psychology and making informed decisions are keys to success. Major events like statements and press conferences can heavily influence stock movements. Individual investors often struggle to compete with institutional investors’ resources and insights. Therefore, it is crucial to remain calm and stick to a consistent investment plan without being swayed by short-term market movements.

In this case, Nakai’s statement may not have seemed convincing to the general public, but it was well received by shareholders. Similarly, while the rationale behind the closed-door nature of President Minato’s press conference is unclear, shareholders seemed to understand its implications. This highlights the importance of thinking like an investor rather than reacting emotionally.

Epilogue: The Role of Foreign Investors and the Need for Self-Regulation

This case demonstrated significant fluctuations and shifts in market sentiment. Some speculate that foreign investors exerted pressure on Fuji TV, encouraging positive changes. However, ultimately, it is crucial for Japan’s media industry to take responsibility for its own transparency and trustworthiness.

Public broadcasters, such as NHK, are expected to maintain media integrity and accountability to their audiences and sponsors. Instead of simply suppressing problems temporarily, the industry must focus on long-term efforts to regain public trust.

What Should National Broadcasters Do?

NHK, as a national broadcaster, should take the lead in maintaining the order of mass media. Issues such as biased reporting during the COVID-19 pandemic, entertainment industry scandals, and political election coverage have led to concerns about media reliability. These issues should not be overlooked.

Similar problems exist in politics, with many people still holding outdated values from past decades. The world has moved on from the bubble economy, and with the dismantling of deep state influences in the U.S., it is time for Japan to follow suit.